Login Via App Token(Android)

Kindly open PolicyBoss Pro App and Click on "Generate Login Token" button in Left Side Menu. Once Login Token is generated, Kindly Enter Token here and Click on "Submit Token to Login"

We have sent you One-Time Password over (WHATSAPP/SMS) on

We have sent you One-Time Password over (WHATSAPP/SMS) on

Boost your Insurance Business with our Unparalled Exclusives!

Experience INDIA-FIRST Features

Experience Simplicity of

Live

Brokerage*

SEE WHAT YOU GET!

1st time in India, see your commission brokerage live on quote page. It’s your ultimate tool for real-time policy insights

Know More...

Experience Advantage of

InstaPay*

GET WHAT YOU SEE!

1st time in India, get Instant commission realisation for your efforts, because your hard work deserves immediate rewards

Know More...

Boost Your Income Potential with SyncContact*

Transform your Phone Contacts into Insurance leads with our patent-pending innovative feature Sync-Contact

Know More...

From initial quotes to post-sales support and claim, enjoy our extensive support services. Gain access to personalized assistance from a dedicated relationship manager, product advisory services, enriching training sessions, centralized endorsement practices, and much more .

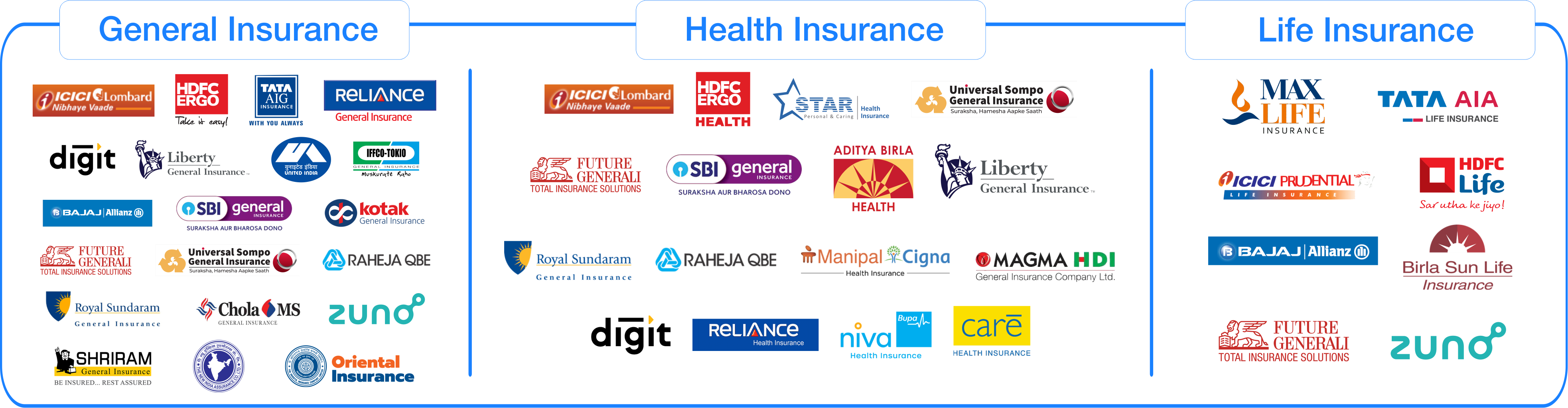

Access plan from 40+ insurers, offering a diverse range of options for your customers across Car, 2W, CV, Health, Life and Travel Insurance. All this from a single login.

Empower Your Success with us. Access our cutting-edge platform seamlessly integrated across mobile and web. With industry-first innovations like SyncContact, InstaPay, and Live Brokerage redefined efficiency, transparency, and instant realization for your hard work.

I'm thrilled with InstaPay by PolicyBoss! No more waiting for weeks to get paid. Now, as soon as I sell a policy, I get paid instantly. It's incredibly motivating .

Live Brokerage is Game Changer. It gives me instant commission visibility right on the quote page, It's like having your earning at your fingertips amazing features great job Team PolicyBoss .

SyncContact transforms your phonebook contacts into insurance leads. It's a smart way to expand your business network effortlessly it saves me from manual prospecting .

Eligibility to Become POSP

Age of 18 years and above (there is no upper age limit), and should be a minimum 10th class pass .

List of Mandatory Documents Required For Becoming A POSP

Explore the top 5 reasons why joining PolicyBoss as a POSP is a game-changer for insurance agents. Unlock exclusive benefits an...

Discover effective strategies to sell insurance online, specifically tailored for reaching millennials. Learn essential tips an...

Explore invaluable tips and the right guidance to achieve your insurance selling goals and exceed sales targets with proven str...

The POSP agent must follow certain strategies to convince the customer and stop the policy cancellation. Let's explore the stra...

In a world where financial security and protection are of utmost importance, insurance plays a crucial role in people's lives.....

A career as an insurance agent is one of the best opportunities for women who want to start or restart their careers. Insurance...

Explore the top 5 reasons why joining PolicyBoss as a POSP is a game-changer for insurance agents. Unlock exclusive benefits an...

Discover effective strategies to sell insurance online, specifically tailored for reaching millennials. Learn essential tips an...

Explore invaluable tips and the right guidance to achieve your insurance selling goals and exceed sales targets with proven str...

The POSP agent must follow certain strategies to convince the customer and stop the policy cancellation. Let's explore the stra...

In a world where financial security and protection are of utmost importance, insurance plays a crucial role in people's lives.....

A career as an insurance agent is one of the best opportunities for women who want to start or restart their careers. Insurance...

As per the Insurance Regulator of India IRDAI, PoSP is a certified insurance agent who can sell insurance products across approved insurance categories from multiple companies without any restrictions. Insurance products like term life plans, motor insurance, health insurance plans and more.

As on the date of appointment as a POSP – you should have attained the age of 18 years and above (there is no upper age limit), and should be a minimum 10th Class Pass.

List of mandatory documents required for becoming a POSP:-

As mandated by the IRDAI Insurance Information Bureau, the PAN No along with other details of POSP needs to be uploaded onto the Insurance Information Bureau POSP Portal, by the appointing/sponsoring entity.

A POSP can start selling POS products after completing the prescribed hours of training, and passing online examination.